Some variable annuities, however, also offer a dealt with account option that pays a set rate of interest. For functions of economic disclosure, an "possession" refers to a rate of interest in property held in a profession or service or for investment or the production of earnings. OGE has actually determined that specific items, by their nature, are held for investment or the manufacturing of earnings, no matter the subjective belief of the possession holder.

If you are unable to make an excellent faith price quote of the worth of a property, you may show on the record that the "worth is not readily ascertainable" in lieu of marking a classification of value. Keep in mind, nonetheless, that you usually should have the ability to make a great faith price quote of value for operating companies.

A loan safeguarded by a boat for personal use is generally reportable. Corporations issue bonds to increase cash.

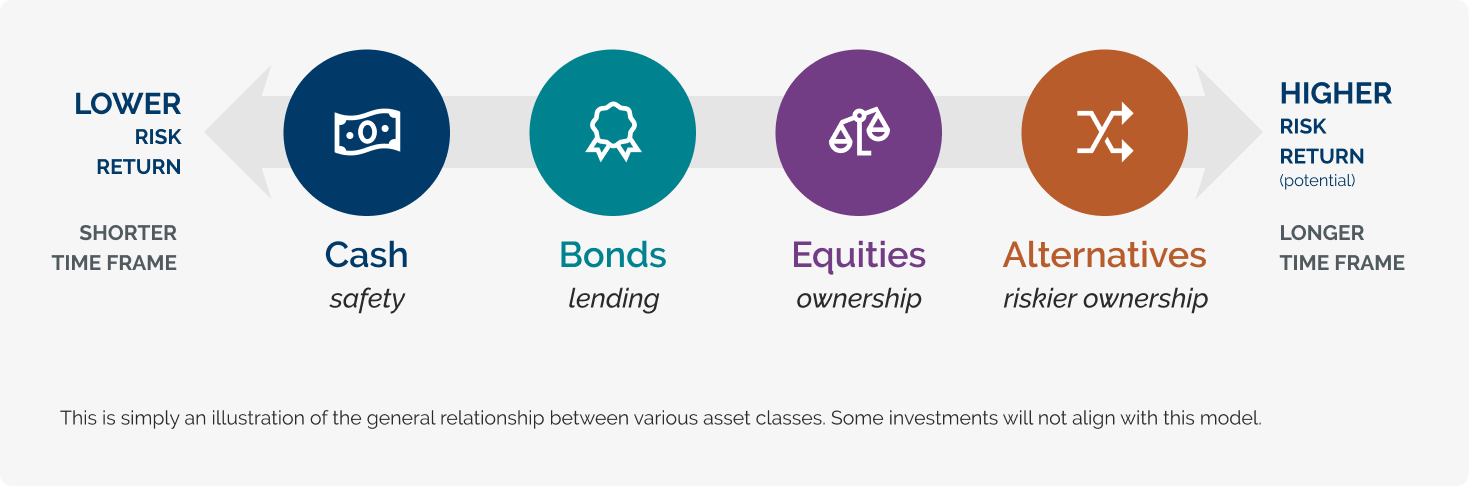

Some bonds are safeguarded by collateral, while others, such as debentures, are backed only by the firm's excellent confidence and credit report standing. Metropolitan bonds, commonly called munis, are financial obligation commitments of states, cities, regions, or various other political subdivisions of states in the United States. The 2 main sorts of community bonds are basic obligation and income.

Investment Management

The individual who establishes the account has the investments in that account. You are not needed to report properties of a profession or service, unless those rate of interests are unconnected to the operations of the business. What constitutes "unassociated" will vary based on the particular situations; however, the adhering to general guidelines use: Publicly traded firms: Properties of a publicly traded company are considered to be associated with the operations of business for objectives of financial disclosure.

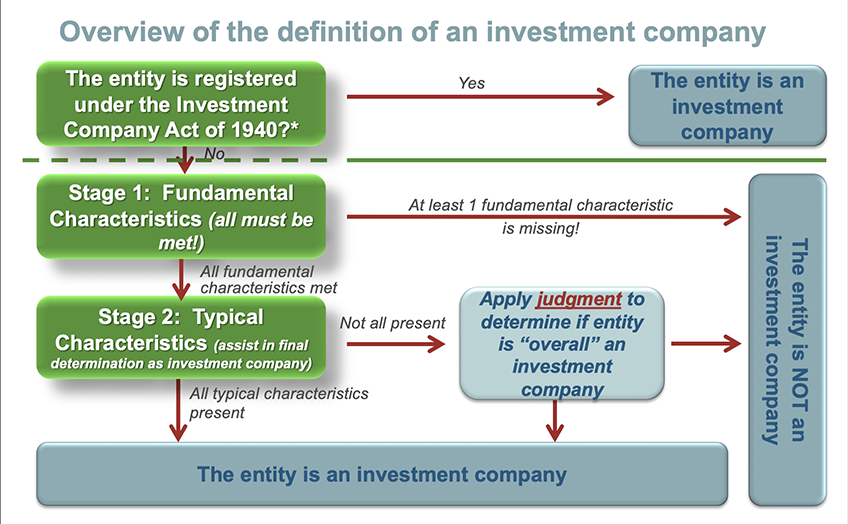

A resources commitment is a legal right coming from an agreement that enables an investment company to require cash that an investor has actually consented to add. When a financier acquires into a financial investment fund, the financier may not have to contribute all of the cash that the capitalist has promised to give the firm that manages the investment fund.

When the mutual fund prepares to purchase investments, the company will release a funding phone call to its capitalists in order to elevate cash for the mutual fund's acquisitions, at which time the investors will require to contribute their promised funds to the company. Carried passions are additionally known as "profit passions" and "motivation charges." For objectives of monetary disclosure, a carried passion is a setup that specifies the right to future repayments based upon the performance of a mutual fund or service.

The company typically makes financial investment choices concerning the holdings of the strategy and births the dangers of financial investment. Yearly, the worker gets a pay credit score that is symmetrical to a percent of the employee's salary and an income credit history that is a set price of return. The employer specifies this retirement benefit as an account balance, and a money balance pension will typically permit an employee to select between an annuity and a lump-sum payment.

Examples of such things consist of artwork, vintage cars, antique furniture, and uncommon stamps or coins. A typical count on fund of a financial institution is a count on that a financial institution takes care of on behalf of a group of getting involved consumers, in order to spend and reinvest their payments to the count on jointly.

Mineral Rights Companies local to Mesquite

The name of a source of compensation might be left out only. if that info is especially figured out to be private as a result of a privileged partnership developed by law; and if the disclosure is particularly restricted: a. by legislation or policy, b. by a rule of an expert licensing organization, or c.

It is rare for a filer to depend on this exception, and it is very unusual for a filer to rely upon this exception for more than a few customers. Instances of scenarios that drop right into one of the three standards described above include: the customer's identity is shielded by a statute or court order or the client's identity is under seal; the customer is the topic of a pending grand jury case or various other non-public investigation in which there are no public filings, declarations, appearances, or reports that recognize the client; disclosure is banned by a regulation of professional conduct that can be enforced by a specialist licensing body; or a written confidentiality agreement, became part of at the time that your services were kept, specifically prohibits disclosure of the client's identity.

Although the nominee has a pre-existing discretion agreement, an IT specialist would certainly not usually have a "blessed partnership developed by law" with customers. The privacy contract is an appropriate standard only if there is already a blessed relationship. The term "contingency charge" describes a sort of cost arrangement in a case in which a lawyer or company agrees that the payment of legal costs will rest upon the effective result of the situation.

The particular arrangements for a backup cost situation need to be stated in a cost agreement, which is an agreement in between the legal representative (or law practice) and the customer that discusses the conditions of the depiction. Co-signed car loans are fundings where a lawful commitment to pay has actually arised from co-signing a promissory note with another.

Navigation

Latest Posts

Mineral Rights Companies

Investment Firms

Bathroom Remodeling Companies local to Mesquite, Texas